Meet Affiniti

Founded in 2022, Affiniti’s mission is to help traditional small businesses streamline their financial operations. Focusing on industries that have often been overlooked by modern fintech solutions–such as pharmacies and podiatry clinics–Affiniti offers an all-in-one financial operating system tailored specifically for these industries.

CEO and Co-Founder, Aaron Bai, founded Affiniti because he saw first hand the difficulty small businesses have accessing financial services when he worked at his first job at a local chamber of commerce. By collaborating with affinity programs through trusted trade associations–where the company derived its name from–Affiniti bridges the gap between high-tech solutions and traditional sectors.

The goal: extend credit fast while keeping bad actors at bay

Trying to provide credit lines and spend management solutions to as many small businesses as possible, Affiniti needed a reliable method to verify their applicants quickly and accurately. Affiniti needed this both to stay compliant with regulations, and to make sure they were protected as a company.

One bad actor only takes away from our focus, [and for our customers,] the quicker they have access to us, the quicker they save time and money.” — Aaron Bai, CEO & Co-Founder, Affiniti

Affiniti evaluated multiple KYB providers including legacy providers such as LexisNexis. When choosing a provider, Affiniti cared most about implementation time, ease of use, compliance, and customer support.

Transforming onboarding with an analyst-friendly KYB solution

Affiniti discovered Middesk through word of mouth and was immediately impressed by its analyst-friendly approach to Know-Your-Business (KYB) solutions. Unlike legacy providers, Middesk required minimal engineering effort to deliver an enhanced user experience.

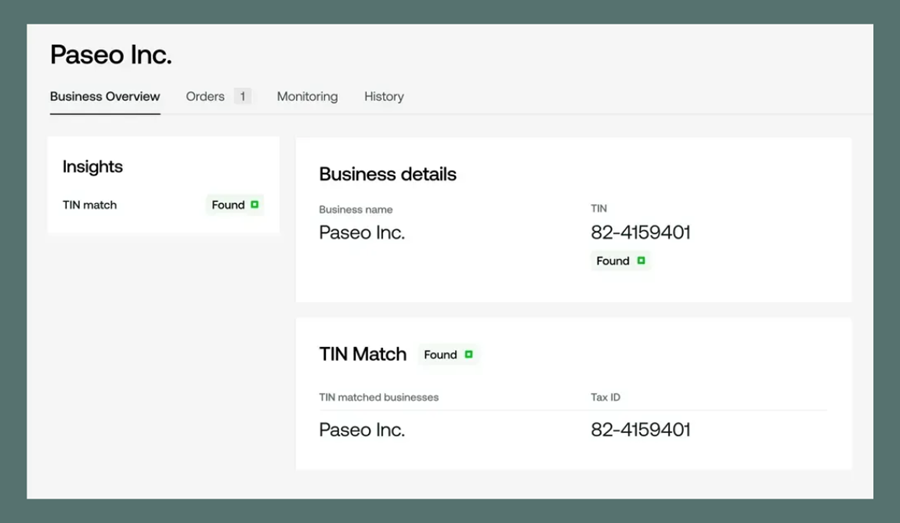

With Middesk’s products–specifically TIN Match and Verify–which Affiniti uses at the top of their onboarding funnel, Affiniti was able to build a comprehensive onboarding solution that facilitated instant verification.

This helped Affiniti ensure compliance with regulations, while also significantly reducing the time taken to onboard small business clients.

Bai shared that verifying and onboarding small business clients can be a challenge because many small businesses are not included in legacy providers data sets. When he evaluated Middesk, he was pleased to find a solution that covers 100% of businesses in the US via direct integrations with all 52 Secretaries of State.

By far, our favorite feature of Middesk is its intuitive dashboard, where our underwriting team and support agents can go in and quickly and easily access anything they need.” — Aaron Bai, CEO & Co-Founder, Affiniti

Affiniti’s overall experience with Middesk—from onboarding to ongoing support—was characterized by seamless implementation and a smooth user experience.

Driving efficiency, trust, and customer satisfaction

The use of Middesk has led to significant business outcomes for Affiniti. Because Affiniti doesn’t need to take on the burden of manually verifying each customer, the company saves an average 1,250 hours of analyst time per year.

Moreover, Affiniti has virtually eliminated the risk of onboarding bad actors, with a flawless track record of onboarding zero to date. Affiniti has been able to safeguard their reputation and foster a secure environment for trusted, legitimate businesses to access credit and thrive.

Finally, Affiniti has dramatically reduced application processing times, giving small business owners swift access to financial solutions. With faster access to credit and other services, they can focus on growing their business without getting bogged down by administrative delays.

The feedback from Affiniti’s customers has been overwhelmingly positive, as they appreciate the seamless onboarding experience and the tailored financial solutions that Affiniti offers. By adopting Middesk, Affiniti has not only streamlined its internal processes but also solidified its position as a trusted partner for small businesses in need of financial services.

This has allowed Affiniti to focus more time on its core mission—bringing Silicon Valley-level technology to traditional sectors—while ensuring that small business owners have access to the resources they need to thrive.

To see how you can implement an automated KYB process like Affiniti did using Middesk, speak to one of our experts and set up a demo. If you want to see it in action, check out our on-demand demo of Middesk Verify right here.

.webp)